Mogadishu,Somalia: Somalia is on the verge of a transformative chapter in its economic history, with oil and gas drilling set to commence early next year. This initiative follows a crucial agreement between the Somali government and the Turkish government, aimed at developing Somalia’s untapped hydrocarbon resources. The operation is expected to propel Somalia into the global energy market, competing with major oil-producing nations.

Agreement and Initial Deployment

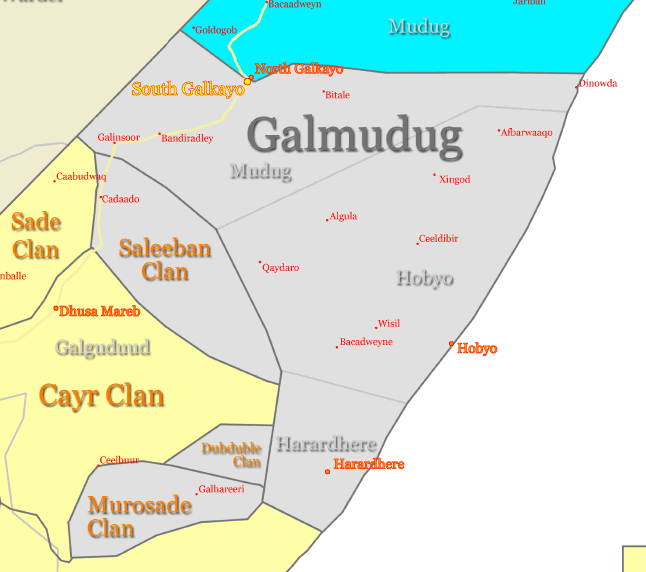

In line with the agreement, a Turkish company, which specializes in electricity and oil, has deployed three ships to the Somali coastline. These vessels arrived earlier this week and are headed towards the city of Hobyo, a strategic location in the Galmudug region. Hobyo’s proximity to significant oil reserves positions it as a key hub for Somalia’s energy future.

Exploration and Drilling Timeline

Somalia’s Minister of Petroleum, Abdirizaq Omar, confirmed that the exploration activities, including underwater surveys, will begin in September 2024. The focus will be on seabed assessments to inform the subsequent drilling process. The first well, expected to tap into the region’s vast oil reserves, will be drilled in March 2025.

Resource Potential and Infrastructure Development

The largest identified oil reserve is located off the coast of Hobyo. According to Minister Omar, this reserve holds an estimated 5.5 billion barrels of oil and gas, making it potentially one of the largest in the world. If successfully developed, it could place Somalia among the leading oil producers globally.

To support the forthcoming drilling operations, significant infrastructure is being developed in Hobyo. A hotel for workers involved in the drilling operations has already been constructed, and a large port is currently under development. This port will play a critical role in facilitating the export of oil and gas, further enhancing Hobyo’s strategic importance in Somalia’s oil industry.

Regional and International Competition

The Galmudug region, where Hobyo is located, is experiencing growing interest from various international players due to its wealth of natural resources, including oil, gold, and uranium. Countries like the United States, China, Turkey, Qatar, the UAE, and Europe are closely watching developments in the region, seeking to gain a foothold in its resource-rich landscape.

The neighboring Puntland region, aligned politically and economically with the UAE, has also attracted attention due to its relationship with the management of the Port of Bosaso. In contrast, the Galmudug administration has so far maintained a policy of economic independence, not aligning itself with foreign interests, positioning itself as a potential partner to diverse international stakeholders.

Political Context

As Galmudug prepares to benefit from its vast natural resources, political preparations are also underway. The region is soon set to hold elections for the President and Members of Parliament. The outcome of these elections will be crucial in determining the direction of oil production policies and partnerships in the region, potentially shaping the future of Somalia’s oil and gas sector

Turkey, seeking to extend its influence in Africa and strengthen energy security, will send the 86-meter long research vessel Oruc Reis to explore offshore oil blocks belonging to Somalia next month.

The move, confirmed by Mohamed Hashi, director of Somalia’s petroleum ministry, could help diversify Turkey’s crude supply and is part of Ankara’s steady quest to boost ties in a region where China, Russia, Gulf states and the West also vie for sway.

Drawn by the continent’s mineral wealth and growing populations that could drive a new wave of economic growth, the focus makes a lot of sense for the county as it flexes its international clout.

“Africa is interesting for Turkey because it’s a point where it can experiment with all its newfound activist foreign policy tools and objectives,” said Batu Co?kun, an Ankara-based research fellow at the Libyan Sadeq Institute think tank.

“It’s soft power on the one hand, such as aid, education and Turkish language centers. And trade and economic relations on the other hand,” he said.

Nowhere is this demonstrated better than Somalia where Turkey operates its largest overseas military base and Turkish companies manage the capital’s port and airport.

Baykar, the Turkish drone company run by the son-in-law of President Recep Tayyip Erdogan, Selcuk Bayraktar, has supplied Somalia with an unknown number of its TB2 model, expanding Somalia’s offensive against the Islamist group al-Shabaab.

Power Play

And earlier this year, the Turkish parliament approved a motion from Erdogan to send navy support to Somali waters amid an increase in piracy stemming from insecurity on the Red Sea linked to attacks by Iran-backed Houthi militants.

“For Turkey, Somalia offers a geo-strategic location to advance its influence in the Horn of Africa and Indian Ocean arenas,” said Omar Mahmood, a senior analyst for East Africa for the International Crisis Group. “The engagement with Somalia has served both a test case and a stepping stone for Turkey’s overall strategy to deepen diplomatic, commercial and security ties across the African continent.”

Ever since famine decimated Somalia’s population in 2011, Turkey has thrown its weight behind the impoverished nation, which has been synonymous with conflict and suffering since a decades-long civil war broke out in 1991.

Today, young Somalis can attend a state-backed Turkish school run by the Maarif Foundation in Hargeisa and Mogadishu. Aid in the past decade was more than $1 billion, according to the Turkish Foreign Ministry, and the country’s consumer goods from medicines to garments are ubiquitous throughout the capital.

“Our connection with Turkey is rooted in centuries of shared Islamic culture. Their support has been transformative,” said Mohamed Osman, an 18-year-old student at the Maarif Foundation school in Mogadishu. Once a run-down shelter for internally displaced people, the school has been refurbished into modern, computer-equipped classrooms.

Abdulkadir Mohamed Nur, Somalia’s defence minister, speaks fluent Turkish and graduated from a university in Ankara.

Since 1992, more than 1,000 Somali students have received scholarships to Turkish universities and visa restrictions for Somalis visiting Turkey have been minimal when compared with other African nations.

Broader Strategy

Turkey’s inroads into Somalia are part of a wider policy in Africa. Exports to the continent were $28.6 billion in 2023, down from $30.6 billion in 2022, according to data compiled by CMD , with the lion’s share going to Egypt, Morocco, South Africa and Nigeria.

Increasingly, Ankara’s dealings with African nations are combining cooperation in the fields of intelligence and defense with deals in the mining and energy sectors.

Earlier this year, a delegation led by Turkish Foreign Minister Hakan Fidan visited Niger’s capital Niamey and signed a host of deals after the nation’s military government kicked out French troops and ordered the US to close its military base.

Niger is the world’s seventh biggest producer of uranium. The Turkish mining company MTA is already looking for gold in the country and has also held talks with Algeria, the Ivory Coast and Zimbabwe in the past three months.

Turkey has signed similar agreements with Algeria where the state energy company, Turkish Petroleum, has said it will look for oil and gas. Afro Turk SA has made efforts to enter Burkina Faso’s gold market and Turkish Airlines now flies to some of the most remote corners of the continent.

TB2 drones from Baykar have been sold to at least 11 African countries, according to data compiled by PAX, a Dutch organization seeking to foster peaceful societies.

Other seeds of influence include SADAT, a private Turkish military contractor, which has sent Syrian personnel to the Sahel region to buttress the military junta in Niger, according to the Syrian Observatory For Human Rights.

Its chief executive, Melih Tanriverdi, told in a written response to questions that his company was keen to do business in Africa but denied its presence in Niger.

Such inroads are made easier by the centralized leadership style of Erdogan, according to Co?kun, the analyst, who noted the lack of export controls on Turkish military products.

“If Erdogan signs off on the deal it simply goes through,” he said. “It’s not like the US congress which scrutinizes every sale.”

Risky Business?

Turkey’s quest for influence in Africa — and particularly Somalia — is not without risks.

Somalia is currently at loggerheads with Ethiopia — another staunch partner of Turkey — over Addis Ababa’s decision to recognize the sovereignty of the breakaway state of Somaliland in return for a naval base and port access in the coastal town of Berbera.

Ankara is currently mediating talks between Ethiopia and Somalia on how to resolve the dispute, a key foreign-policy objective for Ankara if it is to start exploiting oil reserves in the region. That drew a tart complain from Somaliland on Tuesday, which accused it of interference.

“For Turkey the best scenario is coming to an agreement, with Ankara emerging as a mediator and Turkey cementing its role on the political front in East Africa,” said Co?kun. “Turkey does not want clashes when it starts exploring hydrocarbons.”

But the upside should it broker a deal between the two, and tap the oil that lies below Somalia’s seabed, could be huge.

Turkey has long sought to reduce its dependence on energy imports from Russia and Iran, successfully increasing imports from the US, Algeria, Egypt, and Azerbaijan.

“Exploring oil in Somalia’s offshore fields and elsewhere would contribute to Ankara’s diversification strategy, grow Turkey’s energy business, and expand regional presence of Turkish companies,” said Ali Bakir, an assistant professor at Qatar University and a former Qatari diplomat in Turkey.

Conclusion

Somalia, despite being one of the most ground resources countries without a significant history of oil production, is poised to become a major player in the global energy market. The planned oil and gas drilling operations in Hobyo mark the beginning of this journey, with Somalia attracting the attention of major global powers eager to benefit from the country’s rich natural resources. The coming years will be crucial for the country’s economic and political landscape as it seeks to balance internal governance and international partnerships in the pursuit of oil wealth.

Telegaraf Report